CUTTING-EDGE API POWERED DIRECTLY BY A BANK

AVENU: A No Middle Anyware Solution

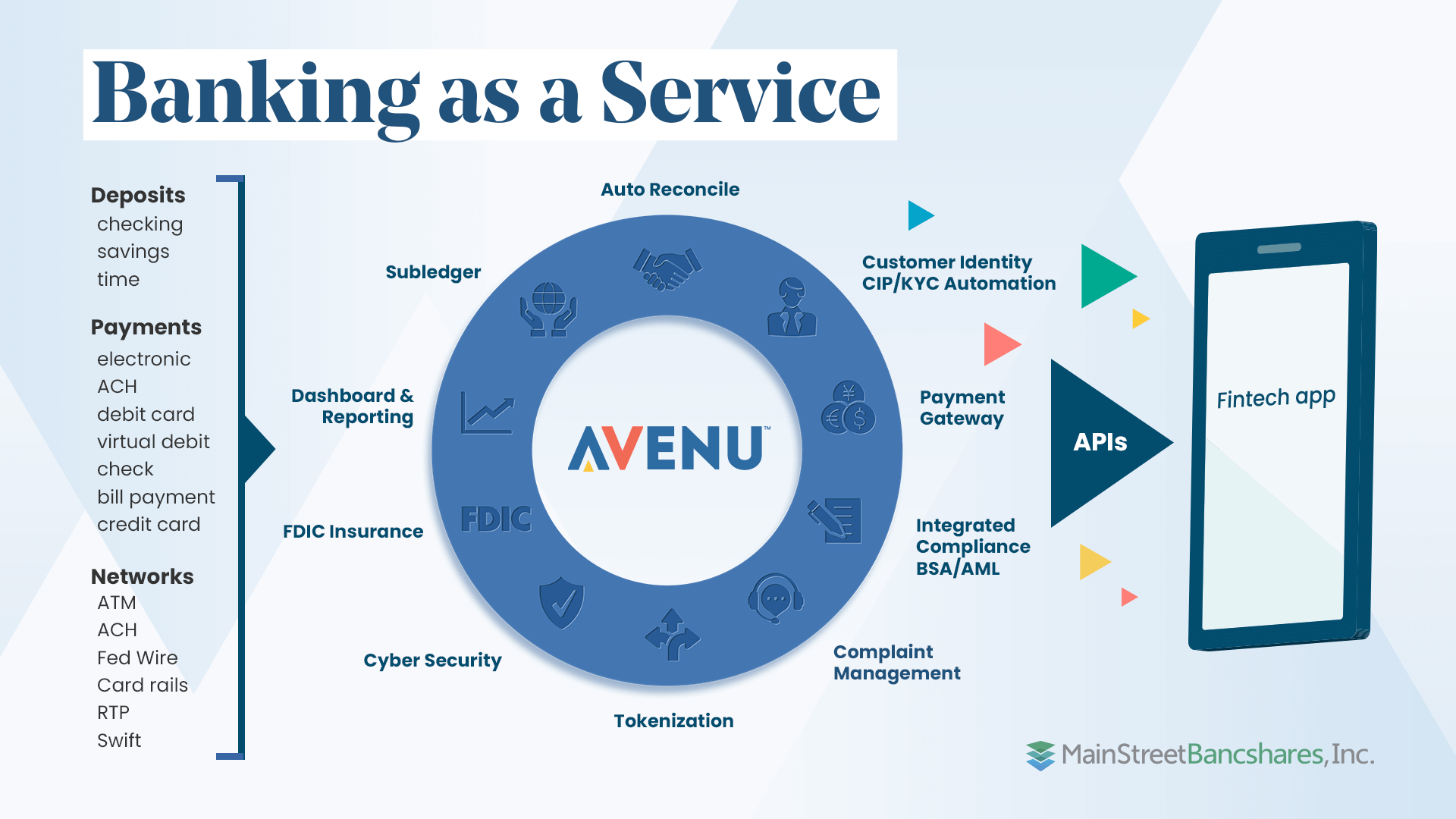

The Fintech industry needs high-powered and reliable banking services to help them deliver a user-friendly, easy and secure embedded payment experience for their clients.

Yet, the banking community has been slow to adopt technological transformations that not only provide Banking-as-a-Service (BaaS) but also application programming interface (API) integration for digital apps.

When a mobile application requires a payment gateway service to allow financial transactions, the process usually requires a middleware company that connects the Fintech to the financial institution (usually a bank). Middleware providers often work with multiple banks. However, because the banks do not control the relationship, this can lead to regulatory issues for the banks.

When one bank decides not to back an app, the middleware company must switch the Fintech to another banking partner that can provide the services and integrations required for the app development. This often results in developers being shuffled from one bank to another — and then, one representative to another.

The biggest challenge Fintechs face is finding a banking partner who understands Fintechs, the Banking as a Service (BaaS) space, and that the Fintech will be transacting as the bank with its customers.

—Todd Youngren, Avenu President

That is, until Avenu.

Avenu, by MainStreet Bank, is leading the way by creating easy-to-use APIs for Fintechs to integrate directly into the Avenu platform. This platform allows Fintechs and other developers to securely innovate, test and deploy their applications — without the need for “middleware.”

Here are three reasons why Avenu is revolutionizing how money moves

A Bank-Powered Solution

At MainStreet Bank, we’re on a mission to make banking services easier to integrate for the Fintech community.

We have years of experience in providing Banking-as-a-Service within a highly regulated industry. And because we’re a bank, there’s no need to assign or rely on “middleware” for safety soundness, compliance duties, or anything else for that matter.

Avenu Is Truly a No Middle Anyware Solution

Here’s what you can expect with Avenu:

- A fully integrated Fintech core processing subledger

- A full banking and compliance solution at scale

- A comprehensive compliance training program with certification credentials

- Sandbox development for proof of concept

- Quick integration and time to market

- The platform provides a streamlined way for Fintechs and other application developers to accept and facilitate payments while managing risk and meeting compliance obligations

All the Tools You Need — In One Place

Today’s consumers expect speed and efficiency from their financial and banking applications. But apps that require various embedded finance solutions can result in a user experience that’s clunky or requires multi-step processes to complete a single transaction.

With Avenu, you get access to a full suite of banking services that allow your application to transact directly and quickly. Customers of Fintechs can create an account, obtain a debit card, and make transactions all from their mobile phone. At the same time, your customers will benefit from Avenu’s state-of-the-art cyber security protocols, such as tokenized transactions. Avenu has everything built in – with KYC, AML and fraud-protection already part of the platform. All Fintechs need to do is connect to Avenu and take advantage of the full suite of services and tools. Our Fintech-in-a-box solution offers a fast, seamless, customer-centric experience.

Access to Compliance Expertise

Fintech organizations often lack the experience and resources to comply with government banking regulations.

That’s why Avenu offers hands-on, in-person compliance training for all customers.

Fintechs have a strong need for knowledgeable, credible partners who can help them manage risk and compliance obligations. Preparing them to become fully compliant is a critical, intensive element of this process, and we are focusing our energy on getting that right

—Todd Youngren, Avenu President

Our in-depth training program is provided by subject-matter experts, giving your team the tools and framework needed to meet today’s rigorous compliance standards.

Additionally, our team is constantly monitoring new regulatory changes and hot topics, so you can focus your energy on what you do best — developing cutting-edge digital financial solutions.

rigorous compliance standards.

Put Our Bank in Your App

Avenu can fully integrate with any existing client application, including blockchain, at scale.

If you’re ready to build a powerful Fintech application, let’s connect it to Avenu so you can process payments in a compliant, safe and secure manner.

©2022, MainStreet Bank. All rights reserved.