CHANGE IS COMING

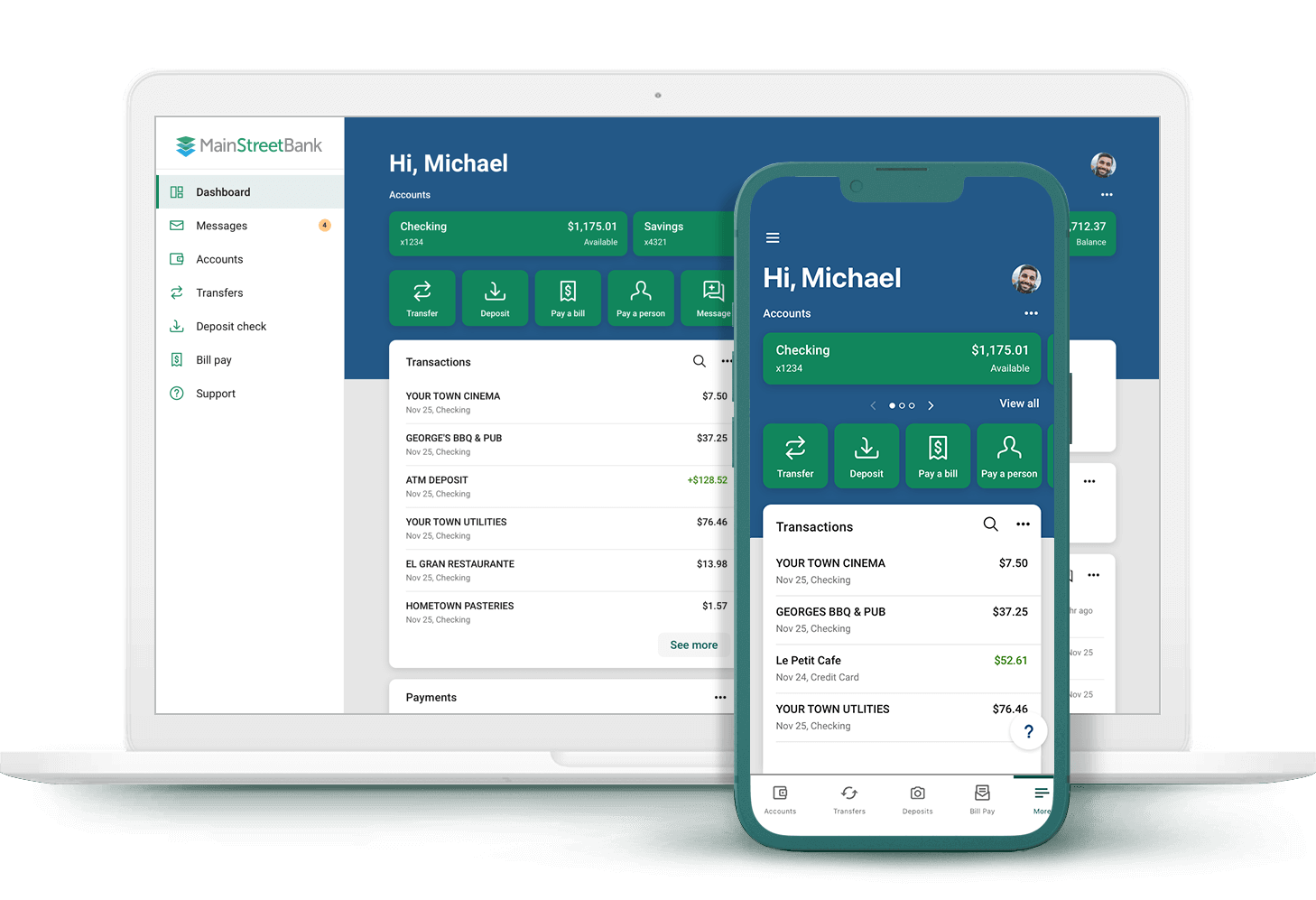

Get Ready for a New Experience in Online Banking!

On Tuesday, August 22, all MainStreet Bank customers will be converted to our new platform — MainStreet Digital Banking. Designed for easy navigation, the platform includes many enhanced features, including multifactor authentication, an important security standard.

You don’t need to do anything special to visit MainStreet Digital Banking — just log in to online or mobile banking with your existing credentials as you usually do. But when you get there, you’ll need to know a few things, so please read on!

Also, if you are using a mobile device, you can download the new MainStreet Digital Banking app from the App Store or Google Play. It will be available on Tuesday, August 22.

To ensure a smooth transition, online banking services will be down from 5pm on Monday, August 21, to 8am on Tuesday, August 22. You may still access your accounts via the mobile app to view your balances and transaction history, but you will be unable to perform transactions during this time. If you anticipate the need to perform transactions, please plan accordingly!

We know that even positive changes take some getting used to — and that’s why we will be here to support you every step of the way. If you have any questions at any time, contact us at 703-481-4589 or email at connect@mstreetbank.com.

Protecting Your Sensitive Data

One of the most important changes you will experience is the shift to multifactor authentication — an increasingly common method of validating that the identity of a user is genuine. You may already be using an authentication app (such as Google Authenticator, Duo Mobile or Authy, to name a few) or using a hard token such as Symantec VIP. Any authenticator device or app will be compatible — but you’ll want to choose one before you log in again.

When you log in for the first time, you will be prompted to set up your multifactor authentication delivery method.

Remember:

- Mobile users can download the new app starting August 22

- Log in as usual starting August 22

- Set up your multifactor authentication

You’re off and running!

With those steps complete, all that remains is to explore the new platform. We’re excited about the new look and feel, and we think you will find it is easy and intuitive to find your way around.

What’s Different

- Do you have alerts set up for existing accounts? These will not carry over. You’ll need to set them up again in the new platform. You’ll have the same capabilities — just a different process.

- Do you send wires internationally in currencies other than U.S. dollars? These transactions will be made using a form within a Conversations module.

- There will be a new way to navigate to manage and delegate access and administration for business users. User management functions within NetTeller Cash Management will still be available.

What’s New

Get Ready for Enhanced Messaging – In-App and on your Desktop

- Upload and download files

- Include transaction links within a chat conversation

- Video-chat and screen-share with our support staff

- Send private and secure messages to other digital banking users from your business

What’s Not Changing

- All existing Bill Pay payees and payments will be carried over to the new platform

- Bill Pay enrollment for business customers will still be accessed through your original Cash Management module

- Direct access to your original Cash Management module will be available to reach existing ACH, Positive Pay and Wire services

- Your last 24 months of eStatements will be available to view and download

- Direct access to your MainStreet Connect payment processing services module will be available to reach existing Remote Deposit and ACH Services

Above all, our commitment to serving you remains front and center at MainStreet Bank! Don’t hesitate to contact us 703-481-4589 or email at connect@mstreetbank.com if you have any questions or concerns!

©2023, MainStreet Bank. All rights reserved.